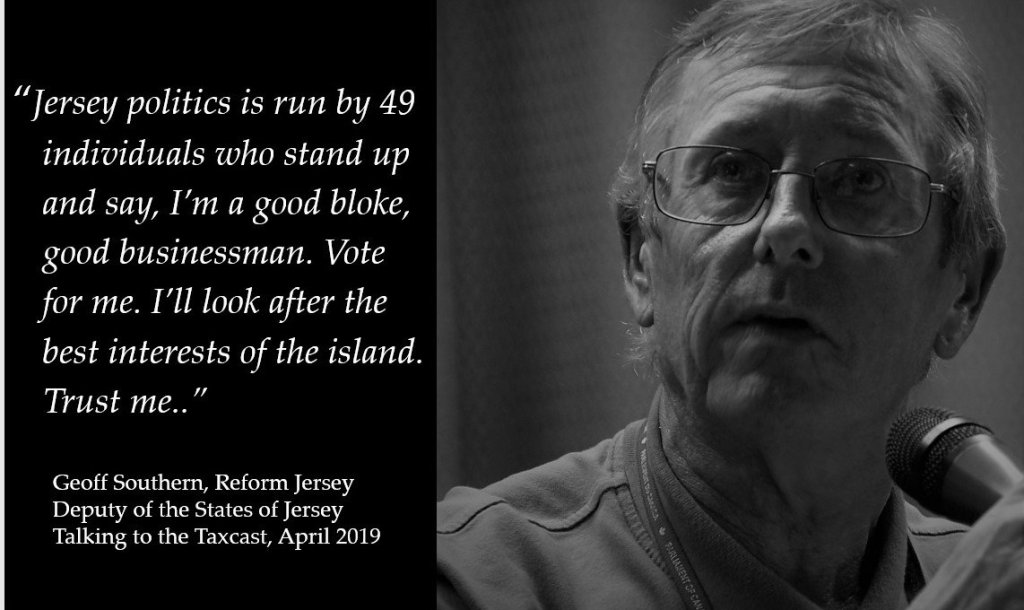

- Geoff Southern

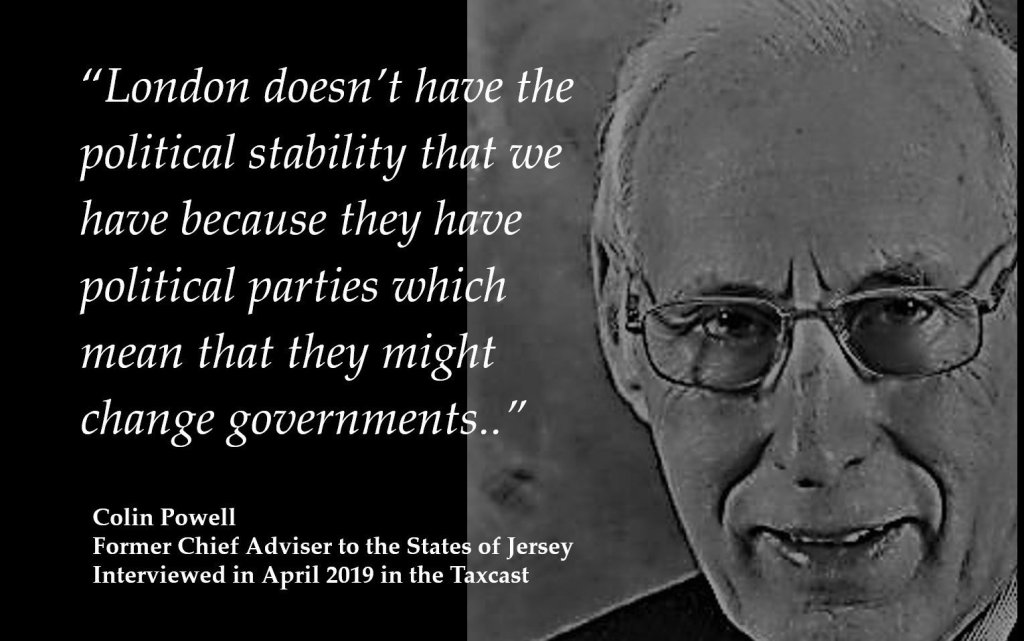

- Colin Powell

-

Graham Barrow

Financial crime sleuth and podcaster, the Dark Money Files

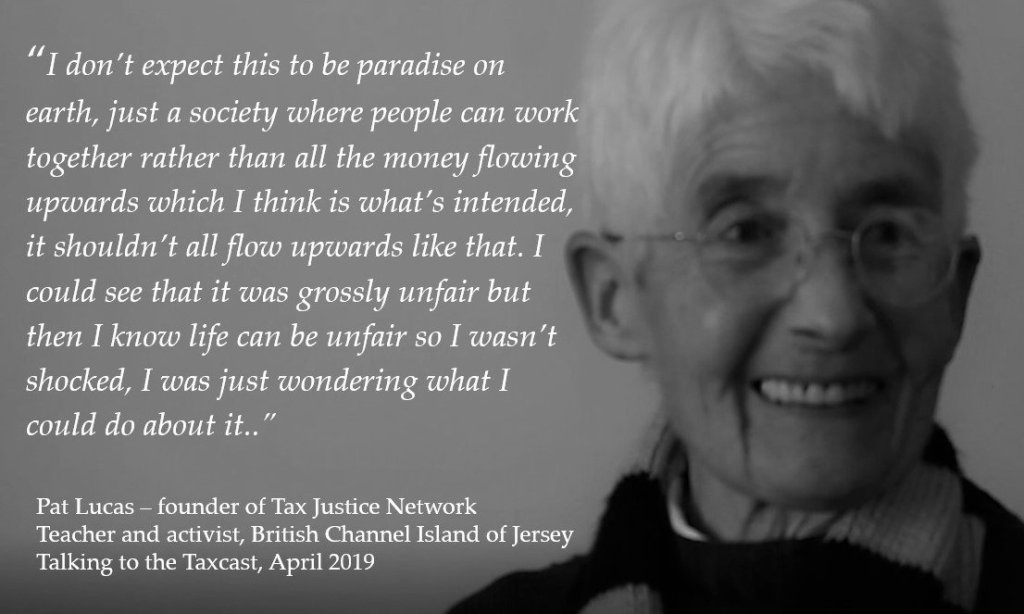

- Pat Lucas

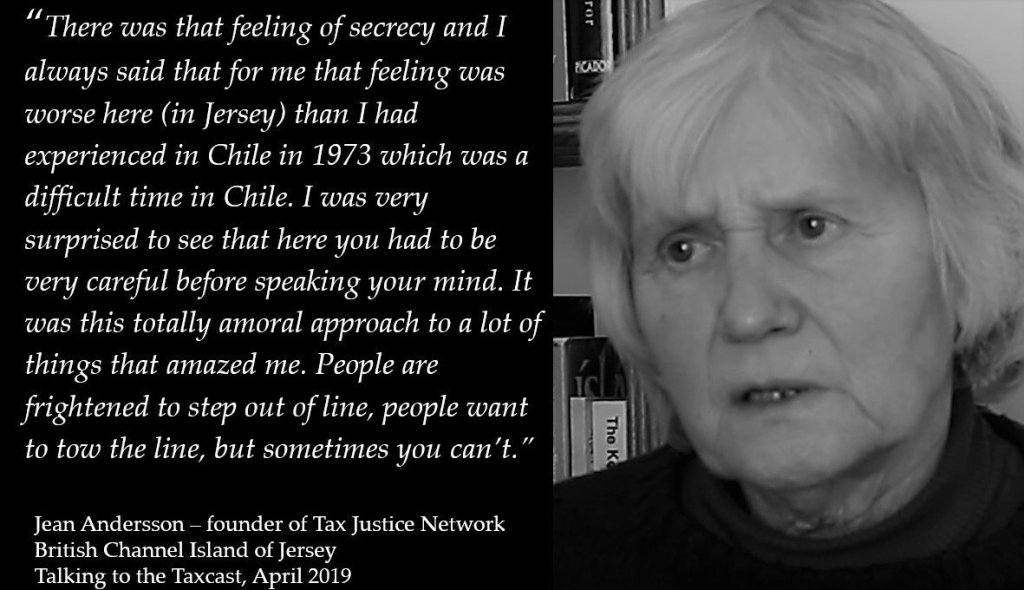

- Jean Andersson

- John Christensen

[taxcast id=”9536582″]

In this special extended edition of the April 2019 Taxcast, broadcast from the tax haven of Jersey:

– we explore Jersey’s poor showing in the OECD’s Better Life Index and ask why Jersey’s spending so much money on improving it’s bad image instead of setting up public registers of beneficial ownership information

– we interview the tax haven of Jersey’s former Chief Advisor to the government, one of Jersey’s main architects of, and defenders of its offshore business model

– we hear about Jersey’s dysfunctional political system from an elected representative of Jersey’s only political party and its rising inequality levels

– we speak to the fire-starters of the global tax justice movement – it all started in Jersey…

Featuring:

- Geoff Southern, elected Deputy and co-founder of Reform Jersey, Jersey’s only political party

- Colin Powell, Jersey’s former Chief Advisor to the government, one of Jersey’s main architects of its offshore business model

- Financial crime consultant Graham Barrow, also of the Dark Money Files podcast

- Two of the fire-starters of the global tax justice movement in Jersey, Pat Lucas and Jean Andersson

- John Christensen of the Tax Justice Network

- Produced and presented by Naomi Fowler of the Tax Justice Network

Want to download to listen to any time offline? Download here.

The person who actually benefits from the income or capital associated with owning something, and/or on whose behalf a transaction is being conducted. They are often different from legal or nominee owners, who may just be proxies who get no benefit from the asset, whose identity is used to hide the real beneficial owner.

A tax haven or secrecy jurisdiction is a place that deliberately provides an escape route for people or entities who live or operate elsewhere. They shield them from whatever taxes, criminal laws, financial regulations, transparency or other constraints they don’t like. Ordinary people whose lives are affected by tax haven laws are not consulted on these laws because they live in other countries: they have no say in how those laws are made, thus undermining their democratic rights.

A tax haven or secrecy jurisdiction is a place that deliberately provides an escape route for people or entities who live or operate elsewhere. They shield them from whatever taxes, criminal laws, financial regulations, transparency or other constraints they don’t like. Ordinary people whose lives are affected by tax haven laws are not consulted on these laws because they live in other countries: they have no say in how those laws are made, thus undermining their democratic rights.

A tax haven or secrecy jurisdiction is a place that deliberately provides an escape route for people or entities who live or operate elsewhere. They shield them from whatever taxes, criminal laws, financial regulations, transparency or other constraints they don’t like. Ordinary people whose lives are affected by tax haven laws are not consulted on these laws because they live in other countries: they have no say in how those laws are made, thus undermining their democratic rights.

Revenue, to fund public services, infrastructure and administration.

Redistribution, to curb inequalities between individuals and between groups.

Repricing, to limit public “bads” such as tobacco consumption and carbon emissions.

Representation, to build healthier democratic processes, recognising that higher reliance of government. spending on tax revenues is strongly linked to higher quality of governance and political representation.

Reparation, to redress the historical legacies of empire and ecological damage.